jersey city property tax calculator

For comparison the median home value in Ocean County is. Account Number Block Lot Qualifier Property Location 18 14502 00011 20.

Here S The Average Property Tax Bill In Newark Newark Nj Patch

Close contenders in terms of property tax affordability are Oklahoma City with property tax being 23 of annual household income and Indianapolis at 25.

. New Jerseys real property tax is an ad valorem tax or a tax according to value. Jersey City NJ 07302 Tel. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000.

Tax amount varies by county. Jersey City establishes tax levies all within the states statutory rules. Please note that you must register your business AND file a return in order for your payment to be properly recorded.

One of the least affordable cities is Northern New Jersey where property tax accounts for 124 of. TO VIEW PROPERTY TAX ASSESSMENTS. New Jersey Income Tax Calculator 2021.

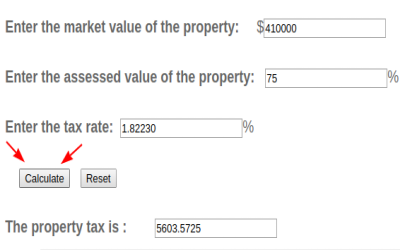

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. DEC 20 2020.

The average effective property tax rate in the Big Apple is just 088 more than half the statewide average rate of 169. Office building store or any building shall display the street number pursuant to City Code 108-5. Start filing your tax return now.

In New York City property tax rates are actually fairly low. In fact many New York counties outside of New York City. Overview of New York Taxes.

An individual taxpayers property taxes are calculated by multiplying the towns general tax rate by the assessed value of the taxpayers property. All real property is assessed according to the same standard. Enter a NJ Municipality.

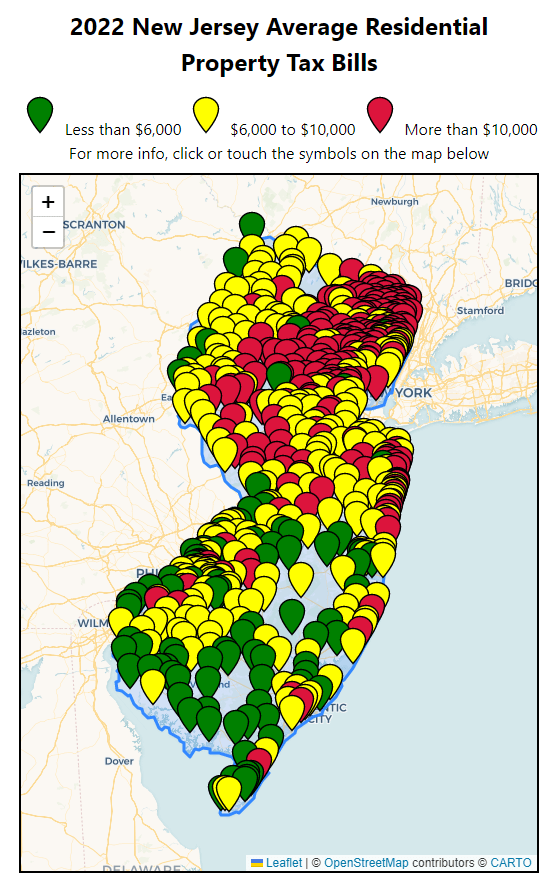

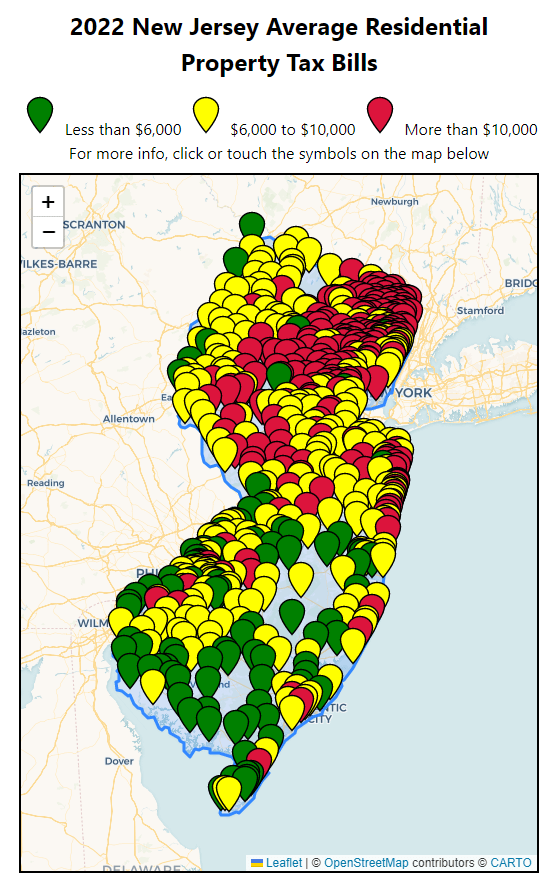

189 of home value. For the City of Jersey City W9 Form click here. In nearly half of New Jerseys counties real estate taxes for the average homeowner are more than 8000 annually.

Left to the county however are appraising property issuing levies making collections enforcing compliance and resolving. For comparison the median home value in New Jersey is. General Property Tax Information.

TO VIEW PROPERTY TAX ASSESSMENTS. Property Tax Calculator - Estimate Any Homes Property Tax. Your average tax rate is 1198 and your marginal tax.

To view Jersey City Tax Rates and Ratios read more here. Online Inquiry Payment. Registration is only required once.

11 rows City of Jersey City. If you make 70000 a year living in the region of New Jersey USA you will be taxed 12783. Office of the City Assessor.

In Bergen and Essex Counties west of New York. Eduardo CToloza CTA City Assessor. Left click on Records Search.

New York Property Tax Calculator. On November 20 2018 the Municipal Council gave final approval to Ordinance 18-133 creating a payroll tax for Jersey City employers.

New Jersey State Taxes 2021 Income And Sales Tax Rates Bankrate

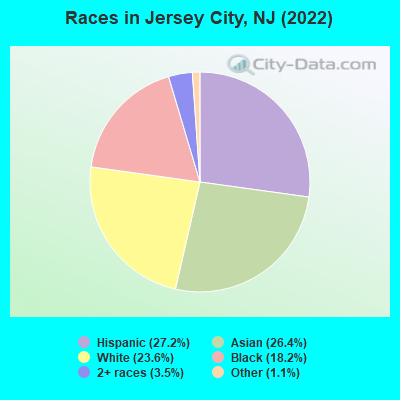

Jersey City New Jersey Nj Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Llc Tax Calculator Definitive Small Business Tax Estimator

Connecticut Property Tax Calculator 2022 Suburbs 101

Property Taxes Understanding Your Colorado Tax Bill

New Jersey Average Residential Tax Bills For Every Town

New York Property Tax Calculator 2020 Empire Center For Public Policy

The Jersey City Real Estate Market Stats Trends For 2022

How To Calculate Real Estate Taxes On Your Property

New Jersey Property Tax Calculator Smartasset

Property Tax Calculator Estimator For Real Estate And Homes

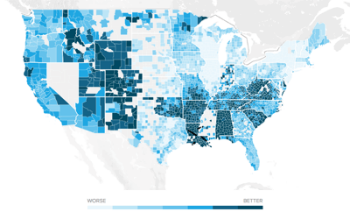

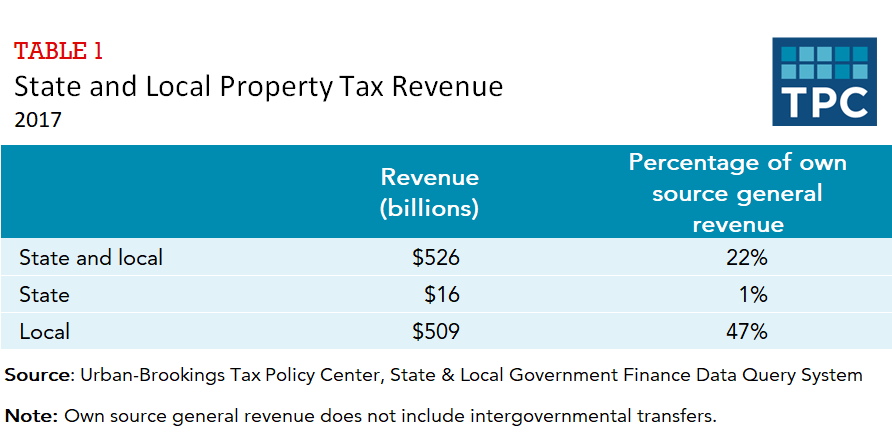

How Do State And Local Property Taxes Work Tax Policy Center

Sales Taxes In The United States Wikipedia

Jersey City School Tax Expense Calculator For 2020 21 School Funding Year Civic Parent

Nyc Property Taxes Compared To New Jersey

Nj Division Of Taxation Sales And Use Tax

Calculator Shows Possible Tax Increase Of Illinois Labor Amendment Illinois Thecentersquare Com